The 'Cherry Sheet' - What Massachusetts Aids and Charges Stoneham.

The Massachusetts Cherry Sheet outlines how over $7.6 billion in state aid and $1.4 billion in assessment (charges) flow between the state and communities (2025 numbers) .

What Is the Cherry Sheet?

The Cherry Sheet, cheekily named for its original page color, is an annual financial document produced by the Massachusetts Department of Revenue. It provides cities and towns with preliminary estimates of state aid and outlines the assessments and charges that localities owe the state for various services. Municipal finance officers, like Stoneham’s Town Administrator, rely on this document to project annual revenues and expenses, ensuring that local budgets are both responsive and balanced. In effect, the Cherry Sheet serves as a “blueprint” for how state-level dollars and obligations flow through to every community in Massachusetts.

The original color of the document, before the mostly digital versions, was cherry red.

Breakdown of Receipt Components

The Cherry Sheet organizes its items broadly into receipts, largely state aid programs, and charges that burden municipalities. Below is the breakdown of the total state receipts provided to all communities. This section follows with detailed description of each major category and its constituent items.

The total Massachusetts funding to communities is dominated by Chapter 70 educational aid.

1. Education Funding

What It Is: Education funding on the Cherry Sheet is the largest revenue stream and is designed to support public education expenditures. This category comprises several elements:

Chapter 70 Aid (K-12 Public Education): This is the cornerstone funding program that allocates state dollars to school districts based on measures such as local income, equalized valuations, and enrollment. In the 2025 estimate, Chapter 70 comprises a significant portion of the total education receipts. Source: These funds come directly from state revenues earmarked for education and are adjusted annually based on local economic conditions and legislative guidelines.

School Transportation: Although a smaller dollar amount, these funds help cover public school transportation costs. They are determined in part by travel distances and the enrollment numbers of each district.

Charter Tuition Reimbursement: This line item provides reimbursements for tuition expenses in charter schools. With a growing number of families choosing charter alternatives, the state budgets specific funds to help cover the cost differential between traditional public expenditure and charter operations.

Smart Growth School Reimbursement: Designed to support initiatives in regions aiming for sustainable development and efficient land use, these dollars offer relief for specific transportation and construction challenges in educational contexts.

Offset Receipts – School Choice Receiving Tuition: These funds represent an “offset” where the state collects fees or reimbursements when students exercise school choice, essentially balancing out the cost of educating students in non-traditional settings.

For FY2025, the Cherry Sheet aggregates these education items into a subtotal of roughly $6.25 billion. This major infusion from the state enables local districts to meet operational costs while also planning for growth and improvements.

2. General Government Funding

What It Is: This section covers state aid for the general operations of town governments. It is structured to help localities cover administrative services and other non-education central functions:

Unrestricted General Government Aid: These funds help cover a broad range of municipal functions from public safety to administrative operations. For FY2025, this alone is estimated to exceed $1.30 billion.

Local Share of Racing Taxes: Many towns receive a designated portion of revenues collected from racing taxes, a revenue stream unique to the way Massachusetts funds certain localized initiatives.

Regional Public Libraries: This ensures that library systems in smaller towns aren’t left behind, providing critical funding to maintain and upgrade public library services.

Veterans Benefits and Elderly Programs: With dedicated funds to support the special needs of veterans and seniors, the Cherry Sheet earmarks several tens of millions of dollars every year. These funds are allocated based on need and the local population’s demographic profile.

State-Owned Land: Revenues from fees or leases on state-owned land contribute additional resources that are reinvested into local government operations.

Offset Receipts – Public Libraries: Just as with education, an offset mechanism exists for public libraries to recoup part of the funding costs through fees or other mechanisms.

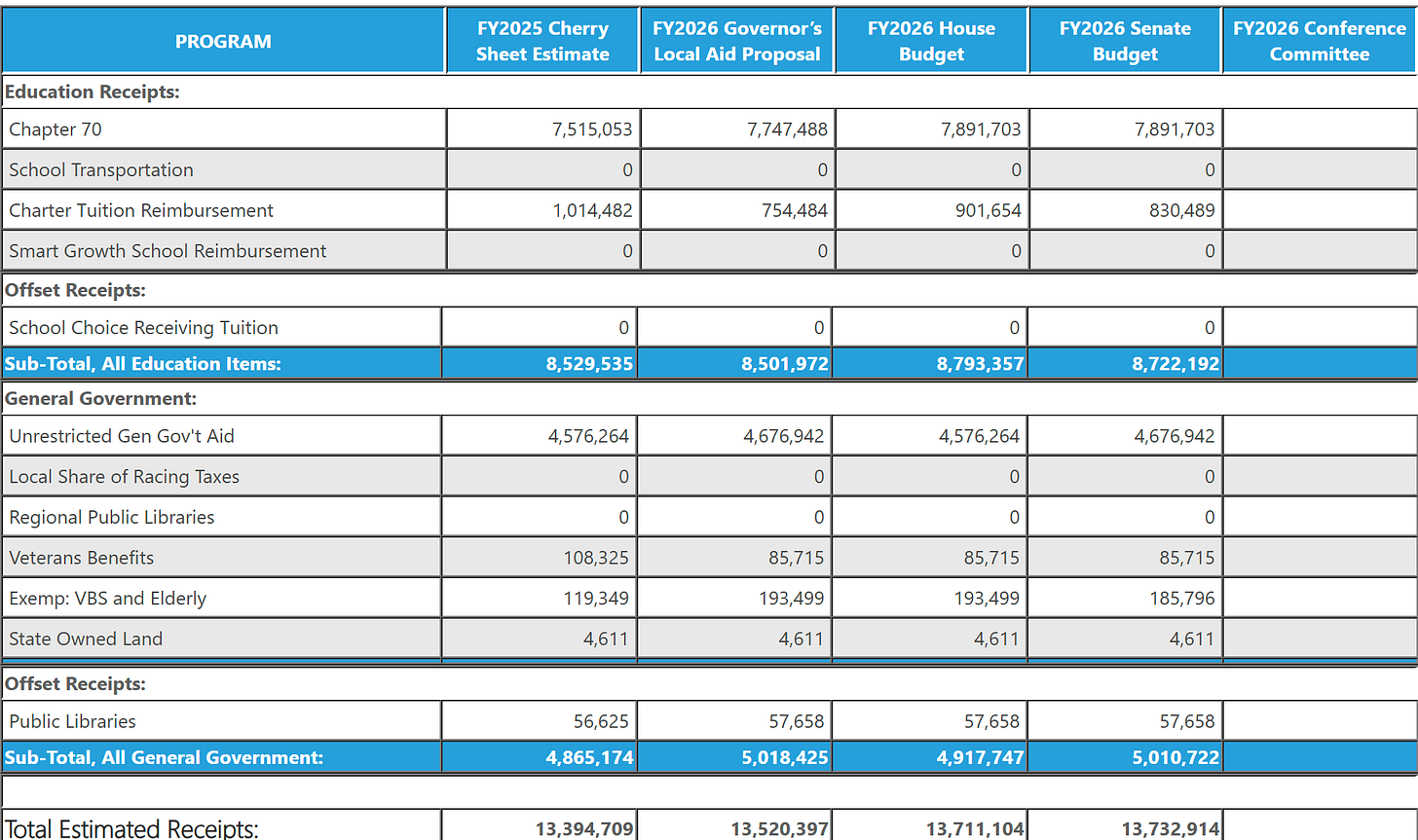

Collectively, these items bring the 2025 General Government subtotal to roughly $1.44 billion. This amount supports the everyday governance needs of Massachusetts towns. Below are the FY2025 and proposed FY2026 receipts for Stoneham, MA. The relative proportion of Unrestricted Aid vs. Chapter 70 Aid is notably higher vs the state-wide allocations. This might be reflective of challenges in proper allocations limited by the school funding formula. Notably as well, school transportation was not funded in FY2025 or in any past years.

Stoneham’s FY2025 receipts finalized by conference committee.

Stoneham’s FY2026 proposed receipts prior to conference committee.

Breakdown of Assessment Components

In addition to direct receipts, the Cherry Sheet lists several charges that towns must pay to the state. These assessments, while not “received” funds, represent financial obligations that reduce the net novel revenue available locally.

The total Massachusetts charges to communities, dominated by charter school tuition.

1. County Assessments

County Taxes and Retirement Funds: A combined charge of around $28 million is imposed to cover regional services that extend beyond individual town borders. This charge ensures that services at the county level, including retirement benefits for county staff, are adequately funded.

2. State Assessments and Charges

Retired Teachers’ Health Insurance: A major charge that covers health benefits for retired public educators, reflecting the state’s commitment to its long-serving workforce.

Mosquito Control Projects: With rising concerns about vector control and public health, funds (in the order of $15–16 million) are allocated for comprehensive mosquito control initiatives.

Air Pollution Districts, Metropolitan & Old Colony Planning Councils: These charges, calculated on a per-municipality basis, support environmental protection and planning services.

RMV Non-Renewal Surcharge: A fee imposed in cases of vehicle registration issues, contributing a significant revenue stream in excess of $12 million.

The total for these state assessments aggregates to around $82 million in FY2025, underscoring the state’s multitiered approach to shared services.

3. Transportation Authorities

MBTA Funding: The Massachusetts Bay Transportation Authority (MBTA) receives a large allocation, approximately $193 million, to support transit services in and around the Boston metropolitan area.

Regional Transit Support: In addition to MBTA funds, around $48 million is earmarked for regional transit needs. These funds are essential in ensuring that towns remain connected to larger economic hubs and that local transportation networks receive necessary support.

4. Annual Charges and Special Education

Annual Charges: This category includes the Multi-Year Repayment Program and Special Education charges (roughly $4.11 million).

5. Tuition Assessments

School Choice Sending Tuition: Charges levied when towns send students to alternative school systems, estimated at about $107 million.

Charter School Sending Tuition: Reflecting the growing presence of charter schools, these charges total nearly $978 million. Combined, the tuition assessments add up to approximately $1.09 billion.

These charges effectively balance the state aid received, ensuring that funding for shared services is equitably distributed across all municipalities.

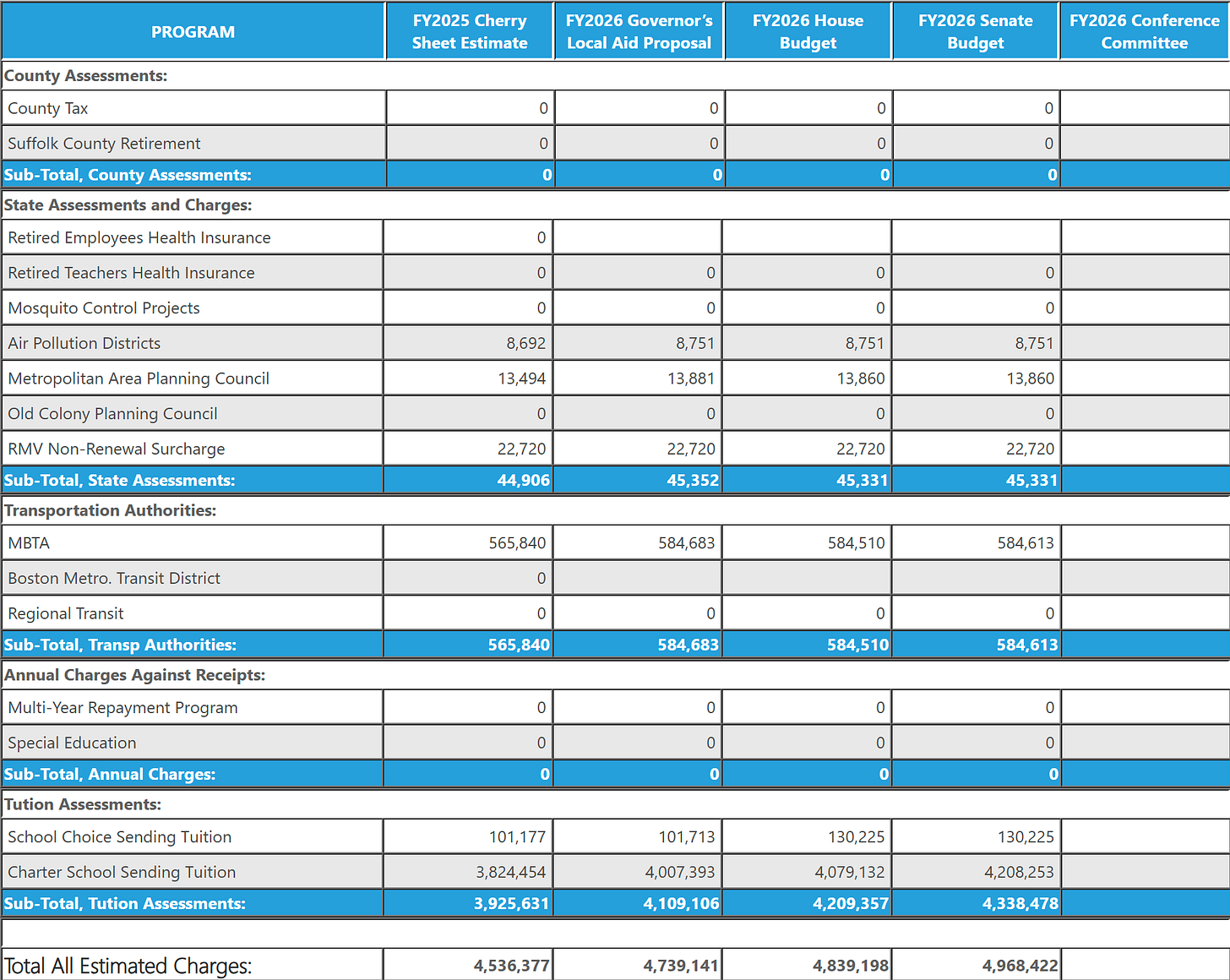

Stoneham’s FY2025 charges are dominated by Charter School Tuitions of nearly $4M.

Stoneham’s FY2026 charges are gain dominated by Charter School tuition realizing a 10% increase.

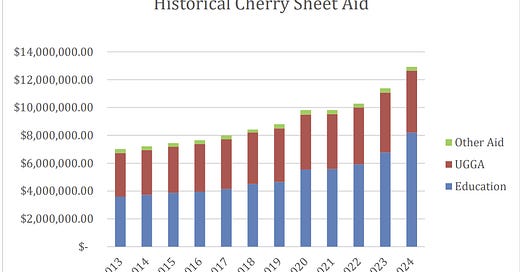

Historical Growth in Stoneham, MA

Over the past decade, Stoneham, MA has experienced a steady increase in both Cherry Sheet aid and assessments, reflecting broader statewide trends in education funding and municipal obligations. From FY2015 to FY2025, state aid to Stoneham, primarily through Chapter 70 education funding and Unrestricted General Government Aid, grew from approximately $7.0 million to over $12 million, supporting local schools, veterans’ services, and public libraries. This is of course balanced by the growth in Charter School reimbursements, which will total over $4 million this year, or 1/3 of that revenue. This evolving balance between aid and obligations underscores the importance of strategic local budgeting, especially as state policy shifts and enrollment patterns influence both revenue and cost structures. If you'd like, I can break this down into a table or chart to show year-over-year changes.

Stoneham has seen considerable growth in it’s Cherry Sheet aid over the last decade, countered by Charter School reimbursements and overall inflationary costs.

In Closing

The Massachusetts Cherry Sheet is a carefully designed financial framework that connects state policy with local governance. By detailing every revenue stream, charge, and mandatory assessment, the Cherry Sheet enables towns to make informed decisions that affect education, public services, and overall community development for the coming year.

For those interested in municipal finance or local governance reforms, delving deeper into each item’s methodology and legislative foundation can reveal much about how the state strives to balance support with accountability. Moreover, comparing year-over-year trends in these figures can help communities understand the broader fiscal shifts influencing local autonomy and service quality.

In towns like Stoneham, for example, understanding these allocations is vital for crafting budgets that meet community needs while aligning with state mandates. This interplay between revenue receipts and mandated charges ultimately shapes local policy, service quality, and overall fiscal health.